Get Rich or Die Trading: 10 Rules to Live By in the Stock Market

Part 2:

Ditch the noise and look inward – avoid shiny distractions and the ‘latest thing’

Stock market news and news services exist for one purpose, to sell advertisements.

Worse yet, those ads are often paid for by the companies that the news service is telling you to buy, without disclosure of the company being an advertising customer.

When Big-City Newspaper runs a story, there’s a joke in the media business that the story exists in the “news hole” and that everything on the page around it; above, below and on both sides are advertisements. The advertisements are the actual reason for the paper, and the news in the middle is the justification to actually go to print. No ads: no newspaper – period. And to make matters even more perverse; the news has to be in line with the advertisers because companies aren’t going to pay the wages of your writers and rent of your office if you publish articles that don’t completely coincide with the advertisers beliefs and views.

Advertising in the markets

The largest advertiser of the NFL is Anheuser-Busch. And if Anheuser-Busch is threatened by something like cannabis, well then you better believe the NFL players are not allowed to use, discuss, work with or be around the plant. Worse yet, the alcohol company (cannabis competitor) mandates that the NFL is not allowed to run cannabis ads during the football games as that may affect beer sales. Sounds like a funny conspiracy but there are massive examples just like this throughout the western world.

Another big and blatant example could be something like the New York Times having very liberal ownership. If the owners of the media business behind the paper think guns should be illegal for example, then you will see a lot of anti-firearm propaganda on their pages. If they find out that for example Mark Zuckerberg of Facebook is a conservative, then they may not accept advertising money from Facebook out of pure ignorance or bias. If a pro-gun lobby wants to run an 2nd amendment ad trying to inform people of politicians trying to take away their rifles, that newspaper will simply not take those advertising dollars because it does not fit the agenda of management. In fact they will always go the other way and publish articles with extreme bias and a view that matches the agenda of said management. You can often feel the anger towards the other side of these large media companies; think Fox News towards liberal views, or CNN towards conservative views; the news used to be about reporting and it is now about opinion and bipartisanship.

CNBC, “first in business” as they say, takes advertising money from public companies to which they expose to you as “great opportunities” or “best of breed”. They will then often feature those public company CEOs on the air and declare what a tremendous opportunity that particular business is for investors right now. They don’t disclose this relationship nor do they provide a counter argument for their claims. A blatant conflict of interest that takes place every day, on almost every media outlet, worldwide. These companies are selling ads and you are the eyeballs – you are the customer. You are very tuning to the channel becomes an engagement which is a statistic to which they sell to the company in order to take that company’s advertising revenue.

This is far worse in and around micro-cap stocks or startup businesses that are publicly traded. In Vancouver, BC for example there is a thriving business of marketing companies employing dozens of spin-doctors that do nothing more than take money from brand new public-startups and try to create stories to describe just what an incredible opportunity this particular start-up is for investors. They will often take the name of other big established businesses in the same arena to create clickbait and to draw in unsuspecting victims to expose them to this new client of theirs. It might be a lithium mining startup that gets a 4-page write-up on why they will be the next big producer of batteries for Tesla. They are okay with these far-fetched claims because at the bottom of the article is a well-crafted legal disclaimer stating that none of this may happen and that the company is a client. So they can say whatever they want.

Next time your newsfeed displays an article such as “These three stocks will rally this year”; scroll down to the very bottom and have a look, you might be surprised to see that within the article is a name drop of some OTC listed startup that paid for the whole article and the clever writer used some clickbait and tagging of some Blue-Chip names to get you to find the article while scrolling on your phone.

It’s always something

If you’ve been an investor or a trader for any period of time you’ll know that there is always something going on on a daily and weekly basis in the markets, influencing the flow of capital. Trade wars, political events, turmoil in the Middle East, bond yields, elections, it’s always something that is often forgot in a mere 10-day news-cycle. Good traders know how to leverage this noise, and also how to mute it and stay disciplined. Whip-sawing back and forth based on the Dow Jones being up or down today is a recipe for frustration and losses – you are chasing no actin. Reacting instead of being pro-active. As Wayne Gretzky eloquently put it, you want to “be where the puck is going to be” and the only way to do that is to not react to news events – to put on the horse blinders so to speak and to stay in your lane.

Go with your gut

The best reason for following your intuition is so that you only have you to blame. There’s not much worse than knowing better and doing it anyway. At least if you stick to your plan and something unforeseen happens you did the best you could. A bad trade despite trying your best happens – it’s part of the business, but a bad trade when you knew better is much harder to accept because you knew better and did it anyway.

The best traders and investors have a very strong sense of intuition and they listen to their gut. If they are overexposed to something, they will start to distribute back into the market and increase cash to feel more balanced. If they feel strongly that there is a large opportunity somewhere, they will start to accumulate in that direction despite the naysayers.

If for no other reason than it provides you the ability to sleep soundly knowing that you are listening to that innate voice inside that is often far more logical than our flawed human brains that often chase squirrels and allow the monkey-brain to give us far more data than we really need.

News is extremely bad for traders as it fuels this ADD-brain and whips you from one extreme to the next, day to day, creating a lot of ‘black and white’ thinking. “In or out” long or short”, “should I or shouldn’t I?” It doesn’t work that way. Traders need to live in the grey area.

Trading is not binary

Amateur traders and investors buy, and then sell. This is wrong.

Professional traders and investors accumulate their positions over time, and then distribute those positions back into the market – over time. A very big difference from buying and selling in two transactions.

Trading is not a black and white game, and it is only when one realizes this that they can become a professional at their craft.

Put another way; you often hear investors say “I sold too soon” or “I bought way too much”. Well guess what; they’re not only right; they’re doing it all wrong.

If you buy ABC stock in January with 1/10th of the position when it was $10, and then buy the rest in 1/5ths over a period of weeks, you’ll not only be protecting your capital in case something goes wrong, but you’ll be able to take advantage of dips and dollar-cost average like the pros.

Once it rolls over at $20 and starts to come back down, you can start to offer up that position and sell in 1/5th sizes, while maintaining control and a core position in case it goes back up. Selling, even more than buying, should be done over time for a number of reasons.

Buy, sell or hold?

One of the biggest every-day questions that any stock or commodity trader faces on a daily basis is the eternal dilemma; “Buy, sell or hold”.

The correct answer is not black and white and it is not one that the financial news can answer for you and even if it could; the answer will vary from one trading session to the next rendering the answer only temporary anyway.

The correct answer if your gut doesn’t feel good about the position could be to “sell half”. Reduce your exposure by 50% in case you are right, and maintain 50% exposure in case you’re wrong, so that you can continue in that position and live to fight another day. I have successfully lived by this mantra.

The correct answer if you’re dying to stay in the position is to simply add a bit more to your position, not double down. This way if you’re wrong and the trade goes against you, you didn’t just double your exposure and you can now start the process of distribution back into the market.

The best piece of advice I was ever given about being long a position and being unsure about getting out vs staying in is; “when in doubt; sell half”. Ditch the noise and make business decisions.

Example

Through all of 2019 my gut absolutely knew that the market was overdue for a correction and that volatility on Wall Street was way too quiet – eerily quiet. Nearing the end of 2019 we saw everything from a trade war with China, to an almost-war with Iran to the quasi-impeachment of President Trump and yet volatility did not blip on Wall Street.

As an insurance policy, I maintained a large call option position on the VXX, which essentially means if there was any big disruption to stocks in general, the VXX (tracks the VIX, ‘volatility index’) would rise and I would be on the right position of the trade owning a call option on the volatility note itself, also serving as a hedge to any losses I would incur on my long stock positions.

It took a full year, but on Monday, February 24th 2020 the Corona Virus fears finally rattled the financial markets, sending the VXX from about $13-$14 the weeks prior, to $23 by the end of that week. My trade was good, and on that Monday, I exited the 290 March calls for a little over $60,000 in realized profits. I was elated at a time when everyone else was panicking.

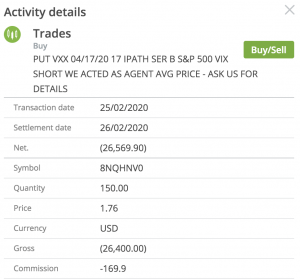

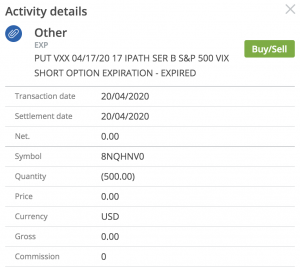

Until I started listening to the news. “The worst is over”. “Tuesday is usually green after a Monday drop of more than 2% on the S&P”. So I went 180 degrees against my gut, still on a greed-high from the 5-figure win, and I went ahead and placed chips on black – I went ahead and bet against the VXX, and bought several put options in an effort to ride it back down for what the media was declaring as an “oversold situation” and a “potential for a bounce tomorrow”. I knew better, but I went short anyway the very index that I was long all of 2019 – because I listened to the noise:

By end of day Tuesday, over $60,000 had evaporated. By Friday, all $75,000 USD was gone.

![]()

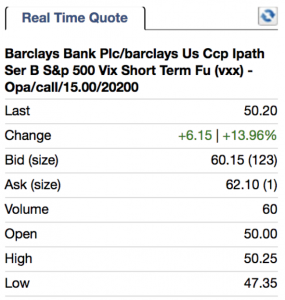

By Monday March 18th, 2020, the 290 March Call options were priced at over $60 each, that would have been a $1,740,000 gain had I held on – as I had planned:

I had not only chopped my winning position way too early and gave up over $1.7 million USD in further gains; I didn’t stick to my plan of exiting slowly and maintaining the hedge (remember …The Plan?)

As a result, I got my ass handed to me on an epic scale despite being in the perfectly correct spot for a full year and then letting my emotions take over at the very moment when I needed to keep my emotions in check… I gave up a $2.2 million (Canadian) payday that I patiently and correctly waited a year for in ONE bad decision based out of fear and greed.

An expensive lesson one might say?

I listened to the noise instead of muting it out and sticking to the plan.